Why You Should Save To A Retirement Account

Saving to a retirement account is more important than ever. Social security benefits are not keeping pace with increases in the cost of living. Fewer and fewer companies are offering pension plans to supplement retirement income for their employees, and many pension benefits have been cut.

Save To Qualified Accounts

When you save to a qualified retirement account, the amount of money you put in each year is generally deductible from your total income. Saving the money pre-tax allows you to add more to your retirement savings account, and lowers your tax burden in the year you contribute.

The money is not taxable until you take withdrawals. You may take withdrawals beginning when you turn age 59.5 without any tax penalties from the IRS. The money is taxed as income in the year in which you take the withdrawal. Any withdrawals taken before age 59.5 from a qualified retirement account will generally result in a 10% tax penalty, in addition to the tax due on the withdrawal.

The benefit to a qualified retirement account is that as long as the money stays in a retirement account (the money can generally be rolled-over or transferred to other forms of retirement accounts free of taxation) it grows completely tax deferred, which increases the total gains significantly over time.

401(k) Accounts With A Match are Best

Saving to your company’s 401(k) account should be your first line of retirement savings, as long as your employer offers you a contribution match.. Many companies will offer a dollar for dollar match, up to a certain percentage of your total pay. A common match is 3%.

If your company has a dollar for dollar match up to 3% of your total pay, they will double your total contribution if you also contribute 3% of your pay. This doubles the rate at which you save money for your retirement. Some 401(k) plans have other matching plans, such as a 50% match up to 3% of your total pay, or a 100% match up to 2% of your pay.

The matching contribution is essentially “free money” from your employer. It is not taxable until the money is withdrawn, and anyone saving for retirement should take advantage of an employer match.

Other types of retirement plans that may include employer contributions are 403(b)s, 457 plans, SEP IRAs, and Simple IRAs. Employers may also contribute to a Roth 401(k), but the taxation on this type of plan is different than other retirement accounts.

No Hassle When Taken From Pay

Another reason that a 401(k) or other similar retirement plan should be your first choice for retirement savings is the regularity and convenience of the contributions. The contributions are deducted directly from your pay, by your employer. This helps to ensure that the money does get saved, and it does not give you the opportunity to spend it. The money does not have to be transferred separately to an investment account, and no action is required by you once the initial setup is in place.

Saving To A Traditional IRA Or Roth IRA

If you have already contributed up to the amount your employer will match in a salary deferral plan such as a 401(k), or if you don’t have the option to contribute to a salary deferral plan, it is important to save to another form of retirement account such as an IRA or Roth IRA plan. Whether you contribute to a Roth IRA or a Traditional IRA account depends upon your income now, and what your expected income will be during retirement.

Roth IRA Account

A Roth IRA account is unlike other retirement accounts from a tax perspective. Contributions to a Roth IRA are not tax deductible, but the money is not taxed when it is withdrawn. It does grow tax free and the benefits are potentially substantial because of the tax free withdrawals, especially if the value of the account becomes very high. There are limits to the amount of income you can make and still contribute to a Roth IRA. For the income limits see the IRS site here.

Traditional IRA Account

Contributions to a Traditional IRA account are tax deductible. The money will grow tax deferred, but upon withdrawals the money is taxed as income. There is a 10% tax penalty for any withdrawals before age 59.5.

A traditional IRA has a yearly contribution limit of $5,500 currently (as of 2014) for people under age 50. If someone is age 50 or older, they may contribute an additional $1,000 per year, for an annual limit of $6,500.

IRA Accounts Can Be Rolled Over

IRA accounts are portable. This means that they can be rolled into other qualified retirement accounts such as 401(k) plans or SEP IRA accounts. A rollover (money moving between different types of qualified plans), and an IRA transfer (money from one IRA account to another IRA account) are both tax free transactions. You can move as much money as you like, as often as you would like to move it, between accounts.

Gramercy Gold Accepts Rollovers

Most of our Gold IRA accounts are the result of an IRA transfer or rollover of an existing account. While we do allow clients to open new accounts with a qualifying purchase, many of our clients decide to turn their existing accounts, or a portion of their existing accounts into physical gold.

if you have questions regarding whether your existing account can be rolled into a Gold IRA account, please call us and our experts can answer any questions you may have.

Saving Early Builds High Account Values for Retirement

The number one key to saving a lot of money for retirement is to start saving early. With compound growth over a long period of time, account values can really soar in time for retirement. If you do not save early, there is not as much time for the account to grow. Here is an example of saving early, compared with saving later in life.

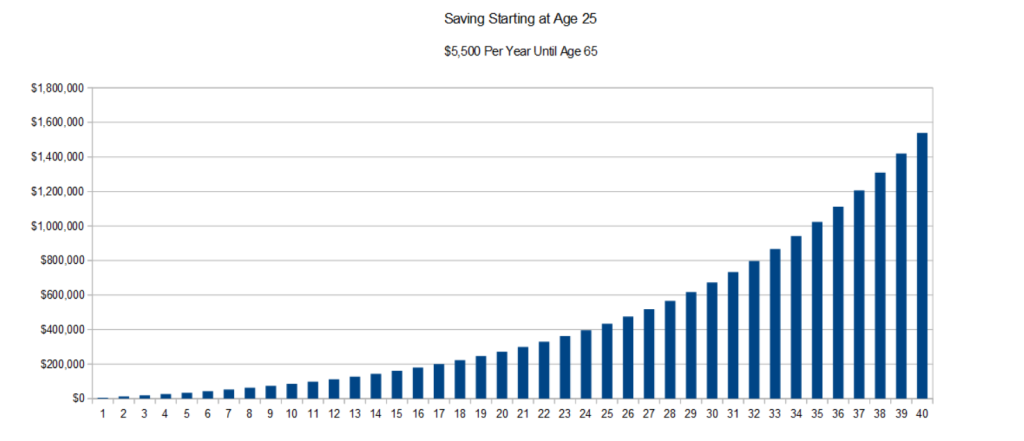

Start Saving at Age 25

If you save $5,500 to your retirement account every year, and start at age 25 (assuming an average of an 8% rate of return), you will retire at age 65 with over 1.5 Million dollars!. Notice how the compounding really speeds the growth in the later years.

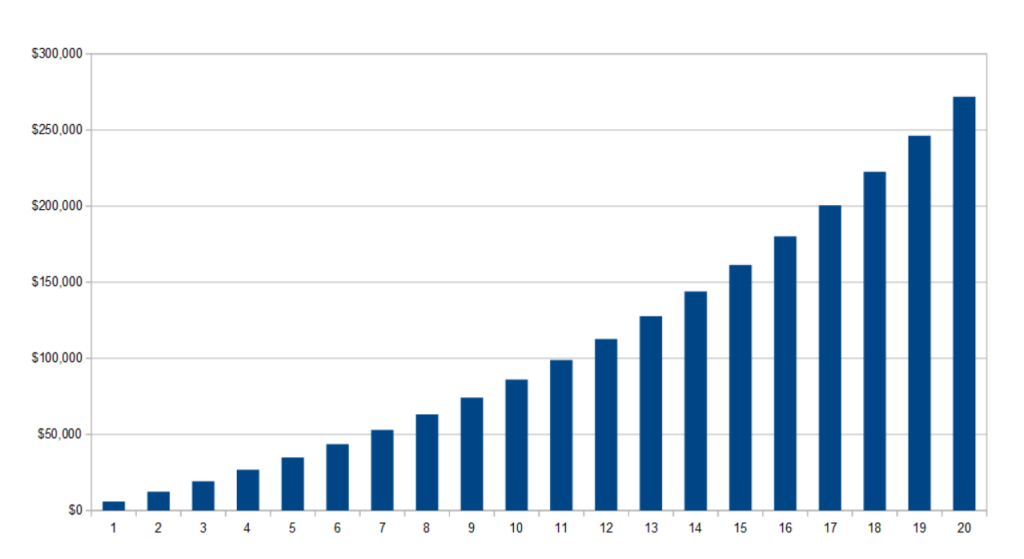

Saving at 45

Starting 20 years later, at age 45 significantly lowers the amount of money in the account at age 65 when compared to a person who starts putting money away at age 25. Assuming a person puts the same $5,500 per year in the account, and it returns an average of 8% a year, a person starting saving at age 45 will have about $270,000 in the account by retirement. This is over a 1.2 million dollar difference!

The difference can largely be accounted for by the additional time the money has to grow in the account.

A Gold IRA Can Grow Significantly In Value Over Time

If you add money to a physical gold IRA account, and save it in gold to retirement, your total investment value will be determined by the price of gold. If you are like many experts and believe that gold will grow significantly in value over the coming years, you have the opportunity to experience tremendous growth in the value of your account. The earlier you get in, the longer the opportunity your money has to be invested in gold.

If you would like to invest is a gold IRA, enter your information in the form above.